February 2024 Eye on ESI Stats Point to Hiring Surge

Contents

The ediscovery job market is warming up after a cool, listless January. This month’s Eye on ESI brought together ACEDS President Michael Quartararo and TRU Staffing Partners’ Founder and CEO Jared Coseglia for a lively conversation about all things related to jobs in the ediscovery industry.

Coseglia: First, here are some takeaways from LegalWeek 2024. I think it was an enlightening show for a variety of reasons because of different things that will impact both the legal industry as well as the ediscovery community. What’s really clear to us at TRU, maybe for the first time in 15 or 20 years, is that it’s no longer just an ediscovery conference.

There was a strong vendor presence, they are spending a lot of money, but they’re also the ones making a lot of money. What was great to see was so many founders and startups that are in the A.I. space and are looking to make their way into legal. My prediction is that we will see a renaissance of providers (service and software) over the next three to five years begin to rise. And then, as things always do in our industry, consolidate over the following three to five years. So, over the next 10 years, A.I. will have a big impact on the legal community. Probably ediscovery will be later than other parts of legal. I know Mike definitely sees eye to eye with me on that.

A.I. Will Soon Have Real Impact

Quartararo: I’m with you because, as you said, 15 or 20 years ago, LegalWeek didn't start as an ediscovery event, then ediscovery became the thing. Now that is giving way to new technologies. However, ediscovery has become much more mature. But anybody who's at the show last week could walk the exhibit hall, or see the signage, and it was clear that it is now A.I. LegalWeek.

Coseglia: The biggest impact A.I. will have this year on ediscovery is the time cost that will affect ediscovery leaders. Practice support managers, client managers, support directors, product leaders, managers, and directors, as well as the C-suite are being pulled into conversations around A.I. in an exploratory fashion. That pull is taking them away from other responsibilities that they will no longer have time to do this year, and perhaps perpetually as those other responsibilities become clear. Someone else will have to do the managerial tasks not getting done. If someone else takes that responsibility, what do they have to relinquish because they don’t have bandwidth? It goes on and on. However, this is good, because this creates a new opportunity for people to get into ediscovery or for contractors to get work doing things that teams, particularly at law firms, no longer have the time or capacity to do.

Quartararo: Are you seeing roles like this yet, or is it still early days?

Coseglia: No, it's still early days. There are A.I.jobs out there, however, we haven't even seen ediscovery people selling these things yet. The first thing to come is a sales ecosystem and service providers who would get reps selling an A.I. solution – this hasn't even happened yet. It’s mostly founder-driven at this point. I think we’re about a year away before we start seeing the codification of jobs. But that’s what will happen this year. For most, it will be about regulation, such as the EU A.I. Act. We’ll see a similar sort of reaction to that like we did with GDPR, which was a job ecosystem for lawyers, the way there was for data protection officers to come in and confirm compliance with regulations, as it relates to how we’re using A.I.

Quartararo: There are several products out there in the startup stage. But it's an immature market. The firms are really not talking about this new technology.

Coseglia: No one’s talking about it. No one wants to talk about what we’re all experimenting with, especially to their competitors. It’s been very difficult to get people to talk about their work with A.I. What people will tell me is how much time they spend dealing with A.I. – about 20% to 30% of their time. As everyone on a team takes on more responsibility, it becomes clearer they need to hire to get work done.

Hiring is Shifting Back In-House

Right now, TRU has as many openings at law firms as we do at service providers. The biggest reason is they are now in-sourcing technology like cloud tech that allows them to scale in ways that they haven't done before. We’re seeing a bigger demand for law firms wanting workers with Rel One processing, people who can come in and just do one piece of the puzzle as the organization scales. ESI sales demand is in an all-time high. All of my customers are looking for good sales reps. So it's really not about what's available. The problem is that the demand is really high, and the available supply is pretty low. What we're experiencing in the industry is a polarization of sales caliber and of vendor size. There are really large vendors that earn $100 million plus, and there are smaller boutiques that earn $20 million. There is very little room in between. Because of this, there is an ecosystem of very successful, expensive sales reps that all the orgs want but hate to pay for, and an ecosystem of those with moderate success.

Quartararo: How does market consolidation play into this? What's the impact?

Coseglia: There is a lot of impact, not the least of which is it’s the only way to really move the needle on revenue growth. The other problem is now as we polarize vendors, and we have big shops and little shops with very little in the middle, your greatest challenge is splitting accounts. That means a rep might be selling $3 million worth of revenue, but only getting origination and attribution for $1.5. It’s the second reason why sales reps have been coming to us in the last 90 days looking for new roles: they’re frustrated with sales deliverables and performance issues. The No. 1 reason is their commission plans change, and that’s always been the biggest concern. Customers are very frustrated with the quality and caliber of customer service that they’re getting from their vendors.

Quartararo: That’s indicative of a changing market. The technology is there and gets you through the process, and it helps you get through the handful of things that you need to get right at each stage of the ediscovery lifecycle. The only way you differentiate yourself is with great project management, great customer responsiveness, great customer service.

TRU's 2024 EDiscovery Jobs Report is Here!

Coseglia: At LegalWeek, TRU released our 2024 eDiscovery Jobs Report. There has never been a report like this published for the ediscovery community. It’s based on people accepting jobs and what they got paid. It discusses what employers are really offering, not what they’re advertising, not what people are getting in terms of raises. This data is at the point of hire, but it covers so much more. You can download a copy here.

Key Job Seeker Motivations

Coseglia: Here is a side-by-side comparison of the motivators over the last two years. One of the biggest differences in 2023 is that a lot of people were unemployed, which was driving job searches. We thought we were going into a recession, and a lot of people got laid off. But No. 5 in 2023 is really what everyone should be looking at, because we've already seen it start to rise in the last 30 days. We think that burnout is going to become a top reason why ediscovery people come to us to change jobs because their employers are understaffed. TRU saw a significant decline in the volume of jobs available for job seekers in 2023, compared to the last three years.

Quartararo: You know what bugs me is that false sense of a recession coming. Everybody held onto their wallets, and it just didn’t happen. Look at the market now. I think that's what caused this problem in 2023. Now organizations are understaffed, and people are stretched thin, and that leads to burnout.

Coseglia: It does. Some law firms went from no hiring in December to a hiring spurt in January. It can turn on a dime in litigation. So as an employer, you must project what your pipeline looks like for business and anticipate hiring needs before they happen. Otherwise, you’re backfilling people. You must hire quickly, because if you don't, no one’s responding to your customers or attorneys. You're missing regulatory compliance or production deadlines. That can't happen.

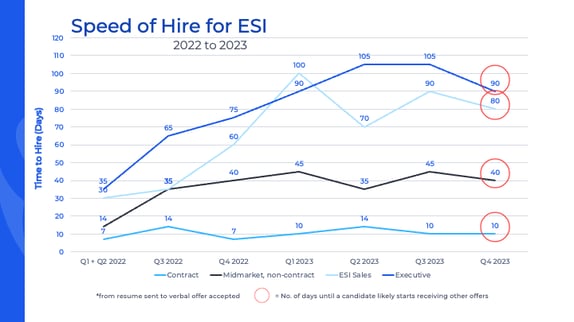

The Zooming Speed of Hire

Coseglia: Speed of hire is the most important change post-pandemic that we all must embrace. As you see on the far left, in the peak of the pandemic, hiring was lightning fast; everyone had to fill these replacement jobs after the Great Resignation. What we’ve seen happen over the last year or so is a stabilization toward a new normal, which is what you see circled in red. So, if you’re an executive at a law firm, it’s about a 90-day hiring process from the time we send a resume to when verbal offers are accepted. It’s an 80-day cycle for a sales professional, 40 days for mid-market (PMs, analysts, etc.), 10 days for contractors. If you wait longer than this, chances are your candidate is going to get another offer, and you won't be the first offer they receive.

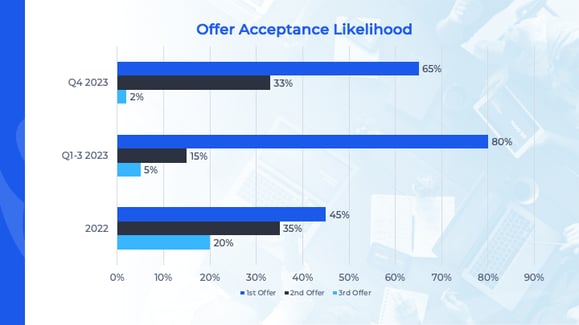

The Offer Acceptance Rate

Coseglia: The slide above shows you offer acceptance likelihood. This is a really important metric. In 2022, if an employer extended an offer, and it was the first offer a candidate received, there was only a 45% likelihood they would take it, because they got multiple offers and they waited to choose which one was best. However, last year if you were the first offer a candidate received, you had an 80% likelihood they would take it. We've never seen a ratio that high. It is because if you move quickly and deliberately in what feels like a down economy, job seekers will take the opportunity before it evaporates. Beginning in the last quarter of 2023, that number dropped to 65%. That tells us more jobs are available. Jobseekers that are in highest demand are now getting multiple offers. Our guidance to all hiring managers is: be fast and be first. Your likelihood of getting a yes increases significantly.

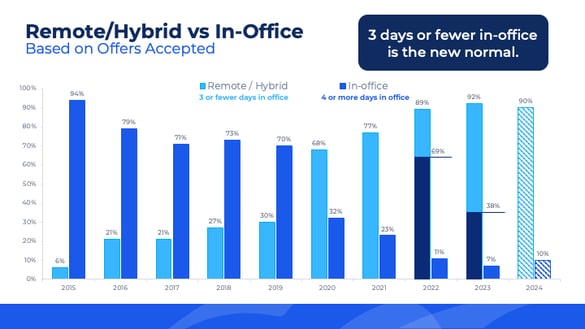

Remote/Hybrid vs. In-Office

Coseglia: In 2015, 94% of jobs had four or more days in an office, and in 2023, 92% three days or less. What's important about those two blue bars in 2022 and 2023: in 2022 89% of jobs were remote or hybrid, but 69% were fully remote. That dropped to only 38% of the 92% in 2023 being fully remote. That tells us three days or fewer in an office is the new normal. But what it also tells us is there aren’t as many fully remote jobs available as there were before. So, if you've got one, and that’s the No. 1 thing motivating you in your job, I would hold onto that job.

We anticipate that we'll see more people going back into the office, but 90% are going to be hybrid at three days or fewer. If you're looking for employees to come in four days or more, your job search could take another 90 days, as shown below.

There is a 25% average increase in base compensation, which is what people expect to leave a fully remote job for a hybrid job, according to our research. And it will take a 90-day extension to fill jobs that require full-time office presence. Then why is the speed of hire so fast? It’s because so few full-time in-office jobs actually get filled. When 92% of them are hybrid or fully remote, there is a 50% increase in available talent. If you drop your in-office requirement from 3 to 2 days, you'll get more candidates. You go from 10 to 15 instantly, because that’s how many more people are open to two days over three in an office.

Contract vs Direct Hire

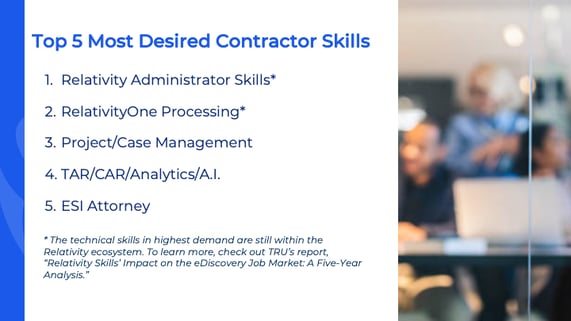

This slide shows a healthy ecosystem, where the job market is 50/50, with the number of contract jobs equal to the number of full-time jobs. It says all types of work, and workers, are available. What I think is really great about that is, there are so many people out there in the industry that are choosing contract as their lifestyle. They get to work with a broad variety of people, assess the company before they commit, and be remote. The next slide shows the Top 5 contractor skills we get requests for, with Relativity Administration and RelativelyOne being the top skills.

What's Coming Up

I expect next month’s Eye on ESI to showcase a change in salary numbers. There's just so much in the pipeline. We’re seeing people make offers and we think that will continue to gain momentum into March. Right now, job seekers with less experience are in hot demand and are making bigger increases when they change jobs. If you're an ediscovery job seeker, and you’ve got less than six years’ experience, now is the time for you to make a move. There are lots of jobs out there for you and you’ll get between a 20% and 32% increase in salary.

It's never too soon to start talking about your career with a professional who can give you guidance. So even if you’re not looking now, that doesn't mean you shouldn't start talking about it now and planning thoughtfully about what's right for you. Reach out to TRU Staffing Partners today: we are here to help navigate all of that with you.

Did you miss the live broadcast of this webinar? Watch the full recording, here.

Just want the monthly compensation metrics? Download the monthly proprietary compensation metrics deck, here.

%20(1).png?width=150&height=51&name=LinkedIn%20Company%20Profile%20Image%20(Email%20Header)%20(1).png)