Part 2: April’s Eye on Privacy Delves Deeper into Job Seeker Motivation and Hiring Manager Considerations

Contents

Here is the second part of the April Eye on Privacy webinar hosted by TRU Staffing Partners’ Founder and CEO Jared Coseglia and HP’s Leader of HP’s Global Center of Excellence for Privacy Engineering Aaron Weller.

Coseglia: Let’s take a look at motivations for job seekers. I find this data most compelling.

As you can see, wanting to work remotely has been the number one motivator for some time now. Money has never been the top motivator, whereas personal growth has always been high. There were more people unemployed last year, so the need for a role made the list for the first time. And now, burnout has now made the list.

At the end of Q1 2024, this is the list of motivators. Burnout has moved to be the No. 1 reason people are seeking new roles. Working remotely is still a strongly desired want from job seekers – even if its one or two days a week more than they currently are able to. There are fewer jobs available and those who are working are compensating for the lack of human capital and want to leave these burdensome roles for places that have more corporate resources. They are seeking a higher quality of life, as well as more personal growth.

Weller: I can definitely relate to this, and I think part of it has become the explosive growth of A.I. A lot of the work for implementing A.I. within organizations has been put onto privacy teams. One of the things that I have taken on in the last couple of months has been developing a leadership team for privacy A.I. at HP. That’s in addition to all of the stuff that I also have to do. So it’s interesting that between No. 1 on the list and No. 4, it’s great when innovation moves into a role and it’s possible to learn new things, but it is a lot more work in addition to what you already have to do. There’s definitely an interesting juxtaposition between those two things. Also, many people moved out of major metropolitan areas during the pandemic. Working remotely more is important because they are hours away from an office. There is a tension between people wanting to work remotely and companies needing to change their in-office policies.

Coseglia: Let’s get right into those stats – that’s a great observation.

This chart shows a mirror image of how roles looked before and after the pandemic. Before the pandemic, almost 75% of the jobs were in-office, then that percentage reversed completely. The dark blue lines in the chart above represent fully remote jobs. The percentage of those roles was high in 2021, slightly less in 2022, but the hybrid jobs went up dramatically in 2022 and 2023.

Now, the new normal is three or fewer days in an office. If you are an employer trying to staff and demanding four or more days in an office, you will have a difficult time finding the best talent. Most of the fully remote roles are filled by contractors.

I predict fully remote jobs will go up because the number of contractors hired will increase as employers try to address burnout, and to circumvent the in-office policies full-time workers must adhere to. The contract-to-hire staffing in the first quarter of this year has been far more extreme than in 2023.

Here’s contract vs. direct hire staffing trends. You can see that when GDPR exploded, we can see a steady increase of contractors. In 2020, contract work outpaced full-time hiring. Then in 2021 and 2022, it was a complete reversal and there was massive full-time hiring. TRU estimates that almost two thirds of the industry changed jobs between 2020 and 2022. Then in 2023, things moved into an equilibrium. I predict more contractors will be hired in 2024 than full-time employees. Here’s an important stat: 38% of all contractors hired through TRU from January of 2023 through today have converted into full-time employees. That is an extraordinarily high rate. The percentage is usually 8 to 12%. That signaled to us that the privacy community needs the option of contract-to-hire to get a person in the door.

Why use contractors? Aaron, I know you love this list. What jumps out at you here?

Weller: I know on my team that we need people with very niche skill sets, and they are in very short supply. The geographic talent shortage can really slow down the hiring process. An employer may have to settle for a lower-level candidate to support their location. I’ve also seen the “check the fit before you commit” practice done many times successfully to evaluate people beyond the resume and interviewing process. But No. 5 – people being plug and play—is a key thing. As new legislation comes up, we’re going to need skilled pros at a very high level. I definitely agree that using contractors is very beneficial.

Weller: I know on my team that we need people with very niche skill sets, and they are in very short supply. The geographic talent shortage can really slow down the hiring process. An employer may have to settle for a lower-level candidate to support their location. I’ve also seen the “check the fit before you commit” practice done many times successfully to evaluate people beyond the resume and interviewing process. But No. 5 – people being plug and play—is a key thing. As new legislation comes up, we’re going to need skilled pros at a very high level. I definitely agree that using contractors is very beneficial.

Coseglia: I know that No. 7 is tied directly to No. 3. If a firm is in Iowa and they need an in-office person, finding that person may take months and it will be costly to relocate them. During that search time, it’s a perfect opportunity to bring in a contractor. However, the number one reason TRU sees employers hiring contractors is because of a lack of full-time headcount approval — and that is a sign of a maturing industry.

Below you can see TRU’s industry breakdown in base salary compensation as compared to the IAPP Salary Survey.

TRU’s data is based on actual jobs accepted. How do we know our data is right? Our bottom ranges are just around what the IAPP salary means are. If people are going to change jobs, then they will expect a jump in salary. This chart gives you a good sense of what people are earning right now.

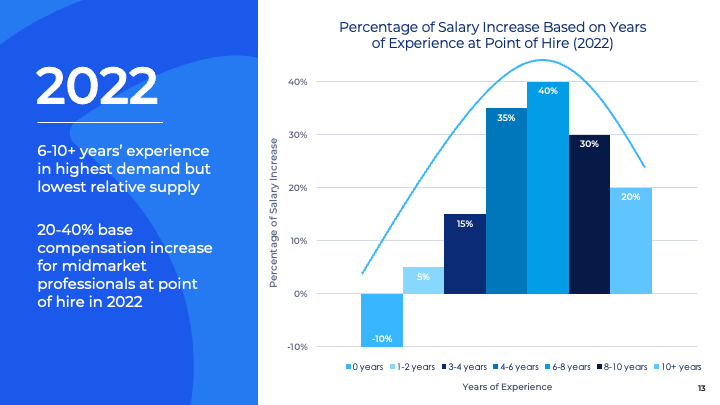

Lastly, here is some data from 2022 and 2023. Back then, most of the hiring was for professionals with four to 10 years of experience. Those people were getting significant bumps in compensation when they changed jobs. The 2022 chart shows these folks were getting between a 20% and 40% increase. Here we tracked what people were earning before they changed jobs and how big of an increase they got.

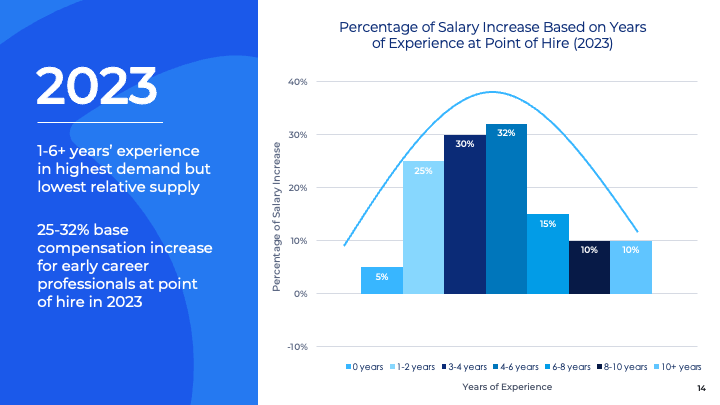

Then, look at 2023. It was the total opposite. The market shifted downward to hire on the lower end of those ranges, where professionals with slightly less experience and lower bumps in salary. What’s important to realize is that if the market doesn’t start moving back toward hiring people with more experience, eventually the folks hired in 2023 will start to catch up to the folks hired in 2022. The demand for people with less experience and at a lower cost is much higher now than the supply of them. As the supply diminishes, the cost will increase despite the years of experience. This will prove difficult for hiring managers to calibrate salary benchmarking in the years to come.

Weller: Yes, it’s an on-going issue. The last thing you want is your people who have been with your company for a while and know how to do things effectively getting priced out by people who are brand new to the company, so keeping track of these trends is critical to keeping the right people motivated and compensated fairly.

As a wrap-up to this webinar, Coseglia offered TRU’s guidance for 2024 to help hiring managers navigate these trends in the data privacy industry:

- Consider all post-pandemic factors — not just compensation — to understand and attract job seekers

- Adjust work-from-home policies to increase the volume and interest of qualified applicants

- Make contractors an ongoing part of your hiring and staffing strategy, not just a default for lack of direct-hire approval

- Advocate for hiring approval now to secure talent before rising market competitiveness boosts salaries and diminishes resources in 2025

%20(1).png?width=150&height=51&name=LinkedIn%20Company%20Profile%20Image%20(Email%20Header)%20(1).png)